Switching to a Medicare Advantage Plan: Pros and Cons

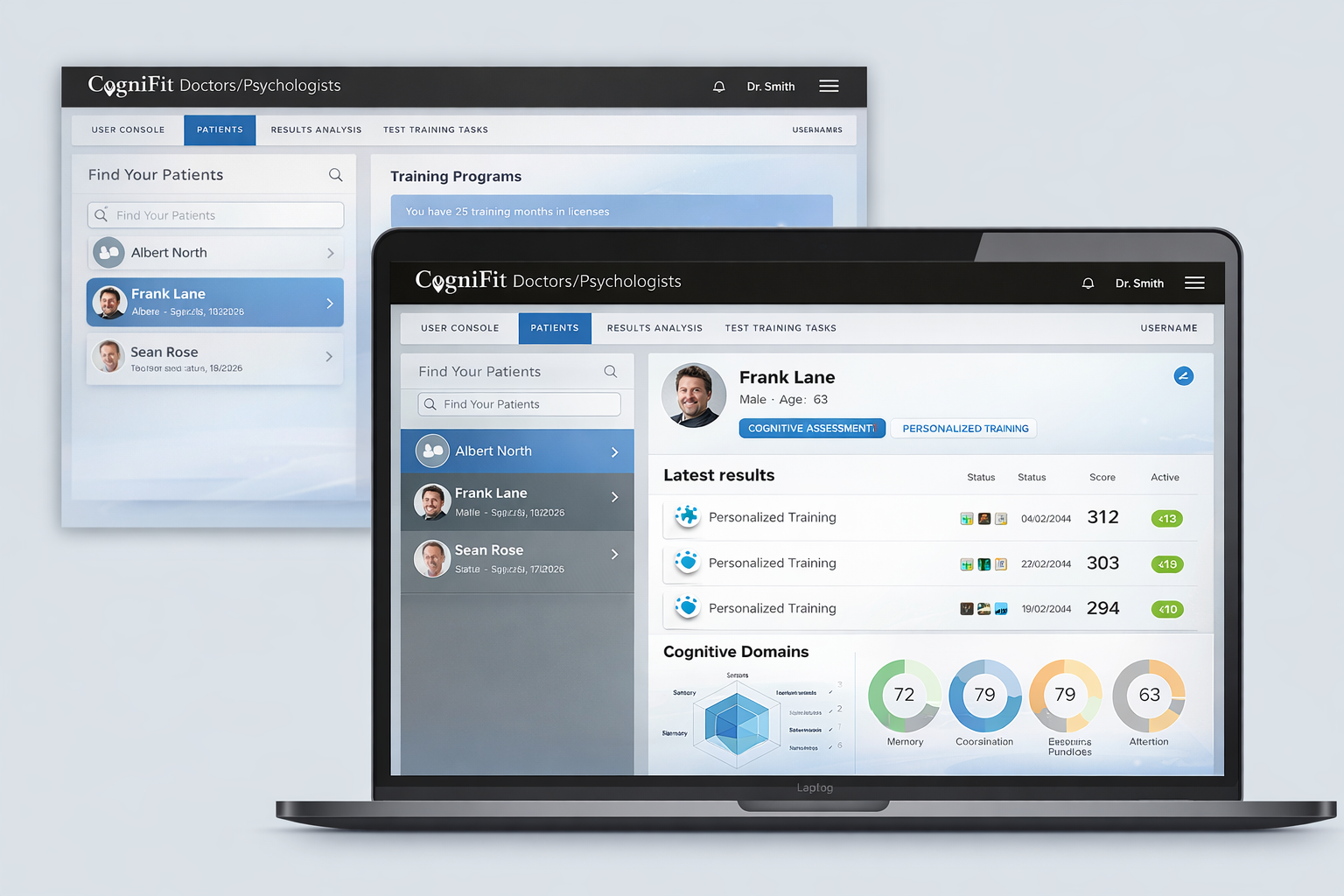

Photo from Kiplinger

A Medicare plan called Medicare Advantage is provided by for-profit insurers that have agreements with the scheme. Medicare Advantage plans may give more benefits and often have lower out-of-pocket costs than standard Medicare, but they also mandate that members only receive care from doctors in their network and get referrals to see specialists.

Medicare is often available to individuals over 65, those with disabilities, end-stage renal illness, amyotrophic lateral sclerosis, and patients who require dialysis or a kidney transplant.

With this plan, the elderly can receive health care services through private insurance companies. Prescription drug coverage, dental, and vision benefits are just a few of the additional features of medicare advantage plans.

But just as there are benefits to this insurance plan, there are also some disadvantages that come with it. In this article, we shall discuss some Medicare Advantage pros and cons to help if you’re planning to switch to a Medicare Advantage plan.

Pros of Switching to a Medicare Advantage Plan

- Out-of-Pocket Maximum

You might not be aware that there is no out-of-pocket maximum for original Medicare. This implies that you might have to spend tens of dollars out of pocket if you have a major health issue.

Out-of-pocket maximums are a feature of all Medicare Advantage plans that keep you from incurring extremely high costs in the event of a major sickness. Once you’ve reached this cap, for the remainder of the year, all Medicare-covered services are paid by your plan. Plans may specify lower but not higher restrictions.

Medicare Advantage plans must provide coverage for at least all of what the original Medicare plans do.

- Prescription drugs

The majority of Medicare Advantage plans cover prescription drugs. This could be good news if you use any prescription medications.

However, you might want to carefully examine the plans you’re considering, making sure they expressly cover your medications and prescription pharmaceuticals.

There’s a formulary for each Medicare Advantage Prescription Drug plan. The formulary and your personal prescription list are comparable. The formulary of a plan may alter at any time. Your plan will notify you when it’s essential.

- Care among your healthcare providers

Medicare Advantage programs often feature networks of contracted healthcare providers and are managed care plans. Health Maintenance Organization Medicare Advantage plans are one example. Most often, subscribers in HMO plans are required to choose a Primary Care Physician (PCP) who assists in coordinating their care.

Medication therapy management is an option in Medicare Advantage plans that provide prescription drugs under Medicare. This care coordination may be both practical and beneficial to your health.

Cons of Medicare Advantage Plan

- It doesn’t work with Medicare Supplement

Medicare Supplement insurance plans and Medicare Advantage are incompatible. Medicare out-of-pocket expenses, including deductibles, copayments, and coinsurance, are covered by Medicare Supplement insurance plans. You cannot receive this assistance if you have a Medicare Advantage plan.

Compare the expenses of Medicare Advantage plans and Medicare Supplement insurance if you frequently visit medical professionals. For the majority of doctor visits, Medicare Advantage plans frequently charge a copayment. Before the plan starts to pay for these visits, you might need to pay a deductible.

- Limited choice of healthcare provider

In principle, Medicare subscribers can visit any physician or institution that accepts Medicare and receive the same benefits for covered services under the federally run Medicare program. In contrast, the provider networks of Medicare Advantage plans might be more constrained.

If you use your plan outside the network, your medical expenses may not be covered or they might not count toward your out-of-pocket maximum.

- Networks

There are numerous HMOs and PPOs in Medicare Advantage programs. There may be provider networks in many Medicare Advantage plans that restrict the doctors and other healthcare professionals that you can use.

If you wish to keep seeing your present doctor, find out if they are part of the network by asking them, or visit the plan’s website to see a list of providers. Some Medicare Advantage plans may provide more freedom to use out-of-network providers than others, and not all Medicare Advantage plans have a provider network.